Our Article

Funding Your Dreams- How to Finance a Small Business

Embarking on a small business venture brings excitement and challenges, notably securing the necessary funding. This guide aims to illuminate the path for entrepreneurs in understanding how to finance a startup and sheds light on different financing options for small businesses.

How to Create a Solid Financial Plan in Your 30s

Now that you are in your 30s, you have a stable job, you may have paid off your student loans, and life is on track. But being in your 30s also means you have many life milestones to achieve, such as buying your home, getting married, saving for retirement, etc. If you are already saving on the side, you have already set the building stone and are more equipped for a better future.

Are BMWs expensive to maintain?

Most people might think of BMW when you mention the idea of "German engineering" in the automobile industry. It's true that BMW produces some of the most impressive and capable premium cars on the market. It's hardly surprising that numerous BMW models appear on automobile wish lists.

Is buying a Lamborghini worth it?

Owning a Lamborghini is a desire shared by a lot of individuals. Fans display posters of these automobiles on their walls and use them as their phone backgrounds.

Porsche 911: Is it worth the hype?

The Porsche 911 is the ideal sports car. Rear-wheel drive (later switched to 4S and Turbo variants), a small and lightweight body, a powerful but well-sized rear engine and four seats have all contributed to the success of one of Germany's foremost exporters since 1963 contribute. Its popularity is undeniable, having sold over a million copies.

Teslas electric vehicles: are they the future?

Tesla continues to dominate the U.S. electric vehicle industry with a 68 percent market share. That percentage is falling as more electric vehicles enter the market. However, the reduction is gradual, and manufacturers are increasing U.S. shipments.

What are BMWs known for?

BMW is America's "most admired" luxury car, and customers are just too happy with the German brand. They are always beautiful and of high quality. BMW produces vehicles with impeccable and attractive designs, components and materials of the highest quality. One of the best-in-class systems in the industry, the company's all-wheel-drive system can handle any landscape or weather.

What do the four rings of Audi represent?

If you've ever wondered what the four rings in the Audi logo represent, you've probably heard a few theories. Maybe they have a link to the Olympic rings? Perhaps they represent the company's four guiding principles. The Audi Silver Spring has received many theories, but we offer the relatively simple truth: The ring represents the history of the automaker.

What is the average lifespan of a Lexus?

Luxury automaker Lexus is known for its luxurious rides, cutting-edge technology and reputation as one of the most reliable vehicles on the road. Drivers can expect to keep their Lexus for up to 20 years or 250-300,000 miles.

What is the Tesla concept all about?

Tesla's mission and vision statements reflect the essence of the well-known electric vehicle industry and related operations. The company's continued commercial expansion indicates a positive market response to its automotive and energy storage solutions.

What makes Audi so popular?

The Audi brand is hugely popular in the automotive industry, and for good reason. They make some very high end luxury cars and premium performance cars. If you're looking for information on why Audi is so popular in the automotive industry, keep reading this article to learn more about why Audi is so popular!

Whats so unique about Teslas business model?

First, Tesla's business model must be a direct-to-consumer (D2C) economy, as it sells directly to customers, eliminates middlemen such as showrooms, and offers its own network of charging stations.

5 ways to save money for your homeowner insurance

Hesitate to buy homeowners insurance because it is too expensive? Click here to learn about 5 ways to produce results on how to save money for your ho

Do my home business need insurance?

Are you confused about whether your home business needs insurance? Delve into this article to answer your questions quickly but comprehensively!

How to file a claim for your stolen car

Has your car been stolen? The following are the basic things you need to know when making a claim for a stolen car.

If I have a previous illness, am I eligible for life insurance

In this article, we will tell you whether people with health problems can apply for life insurance and how they can lower their premiums.

Top 5 homeowner insurance mistakes you should avoid

Click here to learn about the top 5 homeowner insurance mistakes you should avoid so that you can get the most out of your insurance policy!

What is not covered by your auto insurance policy?

Worried about what your car insurance policy does not cover? Get a quick overview of what will happen!

What you need to know about youth car insurance

Has your child just learned to drive? This is all you need to know about youth car insurance.

Which is better-term life insurance or permanent life insurance

In this article, we will explain the difference between regular and permanent life insurance policies so that you can choose the one that suits you be

Reputable Mortgage Lenders

Getting a mortgage to pay for most of the cost of a home can be a stressful and bewildering experience in and of itself. Mortgages are complex, but Select has compiled a list of the five best mortgage lenders to help you narrow down your options and find the one that's right for you.

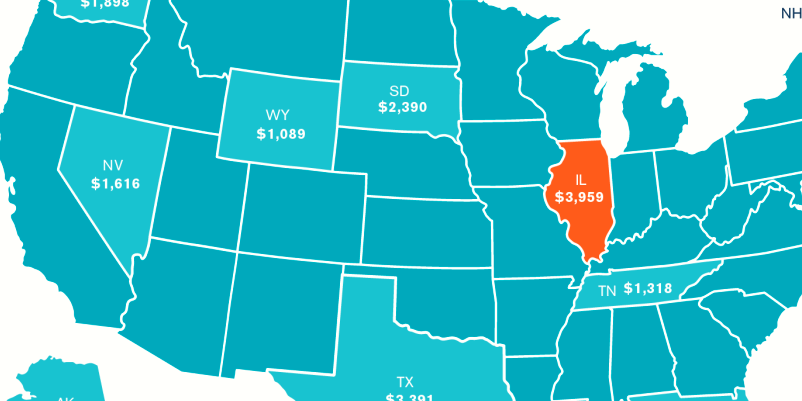

States That Do Not Impose An Income Tax

Alaska is one of only five states that does not impose a sales tax on its residents. It is important to keep in mind that you may be subject to a local sales tax of up to 7.5% if you travel to Alaska from the lower 48 states.

From Zero to Hero- How I Paid off $50,000 in Debt and Built a Six-Figure Net Worth

Debt can be a heavy burden that takes a heavy toll on your finances and well-being. Living paycheck to paycheck and constantly worrying about bills can be overwhelming, but it doesn't have to be. With the right mindset and strategy, getting out of debt and building a solid financial foundation is possible. This article discusses the story of one man who went from debt to building a six-figure net worth.

Protecting Your Wealth

When most people think of investing, they usually think of stocks, bonds, and mutual funds. These traditional investments are popular because they are relatively easy to understand and have a proven track record of generating solid returns over the long term. However, many investors are looking beyond these traditional investments and are considering alternative investments to protect and grow their wealth. What are alternative investments?

Smart Tax Strategies for Small Business Owners- Maximizing Deductions and Minimizing Liability

As a small business owner, taxes can be a significant financial burden. However, there are ways to minimize your tax liability and maximize your deductions by using intelligent tax strategies. This article discusses some of the best tax strategies for small business owners.

The Future of Banking

In recent years, the banking industry has undergone significant changes due to the rise of fintech or financial technology. Fintech has introduced innovative ways of banking, investing, and managing money for people, making it easier and more accessible than ever before. This article looks at the future of banking and how fintech is changing how we bank and invest.

The Pros and Cons of Debt Consolidation

Debt consolidation is a strategy many people use when managing multiple high-interest debts. It's about taking out a new loan to pay off all your existing debt, so you only have to pay once a month. While debt consolidation has some benefits, it's essential to weigh the pros and cons before deciding if it's right for you.

The Rise of ESG Investing- How to Invest Responsibly and Profitably

The rise of ESG (environmental, social, and governance) investing has been one of the most critical trends in the investment world in recent years. ESG investing involves investing in companies prioritizing environmental sustainability, social responsibility, and good governance. This investing approach is popular partly because it allows investors to align their financial goals with their values. This article explores the rise of ESG investing and how to invest responsibly and profitably.

The Rise of Robo-Advisors- How AI is Disrupting Traditional Investment Management

Traditional investment management has been the financial sector of choice for decades, with investors turning to financial advisors or fund managers to manage their portfolios. But in recent years, a new player has come into play: robo-advisors. Robo-advisors are online platforms that use algorithms and artificial intelligence to automate investment management. This disruptive technology is changing the investment management landscape and is on the rise.

Top 10 Financial Mistakes to Avoid

No one is immune to financial mistakes, but learning from them can prevent future errors and protect your wealth. Whether you are just starting your financial journey or are a seasoned investor, avoiding common financial mistakes is critical to achieving your financial goals. Here are the top 10 financial mistakes to avoid:

Retirement Planning 101- How to Prepare for a Comfortable Retirement

Retirement is an important life event that requires careful planning to ensure a comfortable and secure future. It's essential to start planning for retirement early, but there is always time. In this article, we'll cover the basics of retirement planning and offer tips on preparing for a comfortable retirement.

The Top 10 Investment Strategies to Boost Your Portfolio Returns

Investing is one of the best ways to build wealth over time. However, a reasonable investment strategy is essential to ensure you get the most out of your portfolio. This article explores the top 10 investment strategies that can be used to improve portfolio returns.

What is commercial insurance?Commercial insurance can protect companies from losses caused by events

What is commercial insurance?Commercial insurance can protect companies from losses caused by events We often think that we are doing well in life and we don’t need to waste time and money on these insurance plans. On the contrary, even if you have pe

We often think that we are doing well in life and we don’t need to waste time and money on these insurance plans. On the contrary, even if you have pe Investing can be daunting, especially when aligning your investments with your values and beliefs. But imagine a world where your assets could grow your wealth and positively impact society and the environment. Fun, right? That's the power of value-based investing.

Investing can be daunting, especially when aligning your investments with your values and beliefs. But imagine a world where your assets could grow your wealth and positively impact society and the environment. Fun, right? That's the power of value-based investing. You can find checking accounts with a competitive annual percentage yield (APY) and no fees. You may be able to get a better APY if you use direct deposit or make a certain number of purchases with your debit card each month, though. Depending on the bank, you may need to make a certain amount of purchases using your debit card and also have funds sent into your account via direct deposit.

You can find checking accounts with a competitive annual percentage yield (APY) and no fees. You may be able to get a better APY if you use direct deposit or make a certain number of purchases with your debit card each month, though. Depending on the bank, you may need to make a certain amount of purchases using your debit card and also have funds sent into your account via direct deposit. Above, you'll find a mortgage payoff calculator to help you weigh your options, such as making a lump sum payment, setting up automatic biweekly payments, or paying the mortgage off early. It determines how much time is left to pay, how much time is saved compared to other payoff options, and how much interest is saved.

Above, you'll find a mortgage payoff calculator to help you weigh your options, such as making a lump sum payment, setting up automatic biweekly payments, or paying the mortgage off early. It determines how much time is left to pay, how much time is saved compared to other payoff options, and how much interest is saved. A credit-builder loan is not the same as a standard loan in any way. In the case of a conventional loan, you would likely receive the borrowed funds up front and repay them over time. A credit-builder loan, on the other hand, entails making regular payments to a lender before gaining access to the borrowed funds.

A credit-builder loan is not the same as a standard loan in any way. In the case of a conventional loan, you would likely receive the borrowed funds up front and repay them over time. A credit-builder loan, on the other hand, entails making regular payments to a lender before gaining access to the borrowed funds. A licenced insurance broker is a type of financial advisor who focuses on the insurance industry. They are professionals who can advise you on the best insurance policy to meet your needs at a cost you can manage.

A licenced insurance broker is a type of financial advisor who focuses on the insurance industry. They are professionals who can advise you on the best insurance policy to meet your needs at a cost you can manage. Your bankruptcy lawyer is there to protect your interests and help you make sense of what may be a complex process. The first step toward a successful bankruptcy filing is to get in touch with a few attorneys and get their opinions on your situation.

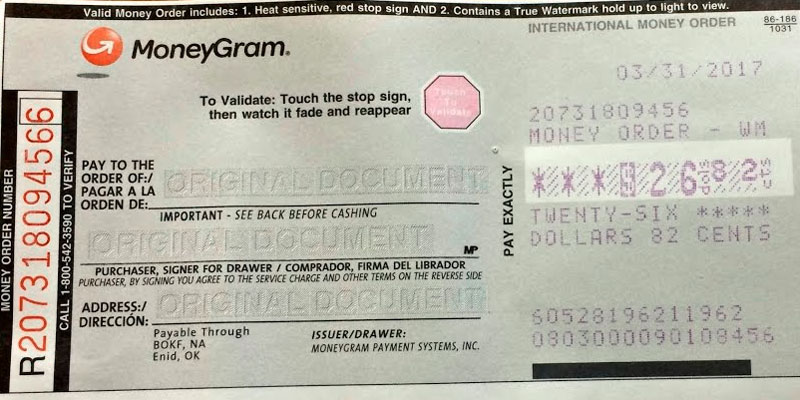

Your bankruptcy lawyer is there to protect your interests and help you make sense of what may be a complex process. The first step toward a successful bankruptcy filing is to get in touch with a few attorneys and get their opinions on your situation. To ensure that the payee is able to successfully cash the order, it is imperative that the name on the order be correct, just as it would be on a check. Purchaser: The information of the purchaser, that is you, is required for the following part of the transaction. Please print out your full name and address.

To ensure that the payee is able to successfully cash the order, it is imperative that the name on the order be correct, just as it would be on a check. Purchaser: The information of the purchaser, that is you, is required for the following part of the transaction. Please print out your full name and address. When you use Direct Pay, a debit or credit card, or EFTPS to pay the IRS, and then choose Form 4868 or extension, you'll get a six-month extension automatically. There will be no need to submit Form 4868, If you fall into this category, you should file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

When you use Direct Pay, a debit or credit card, or EFTPS to pay the IRS, and then choose Form 4868 or extension, you'll get a six-month extension automatically. There will be no need to submit Form 4868, If you fall into this category, you should file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.