Why is Long Term Disability Insurance Vital?

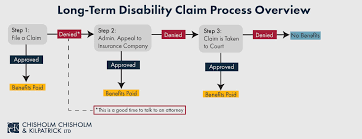

We choose to live in a fictitious world, where we assume and pray that nothing will happen to us. Although some of us may successfully endure these unrealistic assumptions, many will suffer. If you have family members and take care of them deeply, you must purchase long-term disability insurance. LTD insurance helps us to live a more relaxed life because we know that people who are financially dependent will receive large expenditures to help pay for the income you should have given them. A large part of the population has experienced these unforeseen circumstances and considered long-term disability insurance because they think they will never need it. Long-term disability insurance starts after you have been approved by the insurance company, you have accepted the underwriting proposal provided, and you start paying the premiums. Depending on the situation and time, your waiting period may be extended to nearly 365 days.

Term disability

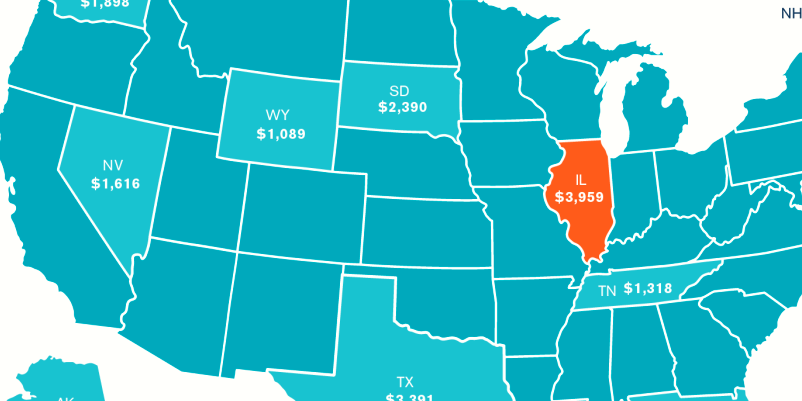

When you say that a person is eligible for LTD insurance, you automatically apply that they have physical and mental disabilities, restricting them from carrying out their usual lifestyle. Depending on the individual's illness or injury, the restriction can be temporary or permanent. This is a global problem that needs to be resolved and taken seriously, otherwise these damages will lead to huge hospital bills and ultimately bankruptcy.

How does long-term disability insurance work?

Long-term disability insurance can prevent you from suddenly interrupting your usual lifestyle in the event of any serious injury or illness. It also includes any permanent disability that may force a person to leave work. Regardless of your health, all employees should consider this plan to ensure a better future for themselves and their families.

What constitutes this plan?

The amount of the refund depends on the policy you encounter, but in most cases, all individuals who cannot return to work will receive the majority of their income. If you have to quit your job due to health reasons and engage in a lower-income job, the insurance will guarantee a higher income in monthly installments. Having said that, there are some specific exclusions that may apply to this insurance. If there is any self-injury accident, if you harm your body without considering the consequences, you may not be eligible for this insurance. If you deliberately have an accident while drunk or addicted to criminal activities, they will restrict you from benefiting from this insurance.

Bottom line

It is our honor to work and provide for the people we love, but have you ever wondered what would happen if you suddenly lose your ability to work? LTD guarantees that a person can maintain their previous lifestyle even if they lose the ability to earn income. The idea of earning a lasting income with the help of long-term disability insurance is great. Remember, the possibility of disability risk is higher than you think.