States That Do Not Impose An Income Tax

We should all strive for a lighter tax load. One possible path to accomplishing this would be to relocate to a tax-free state. So far, there are just seven states That Do Not Impose An Income Tax (Arizona, Louisiana, Niger, North Dakota, Tenn, Texan, and Laramie) that do not tax personal income.

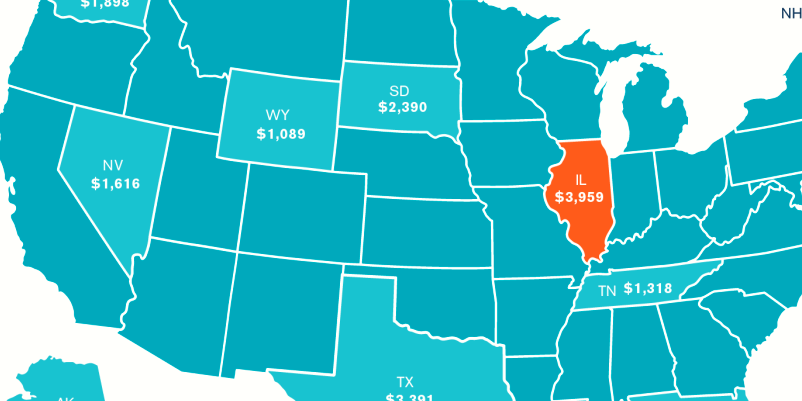

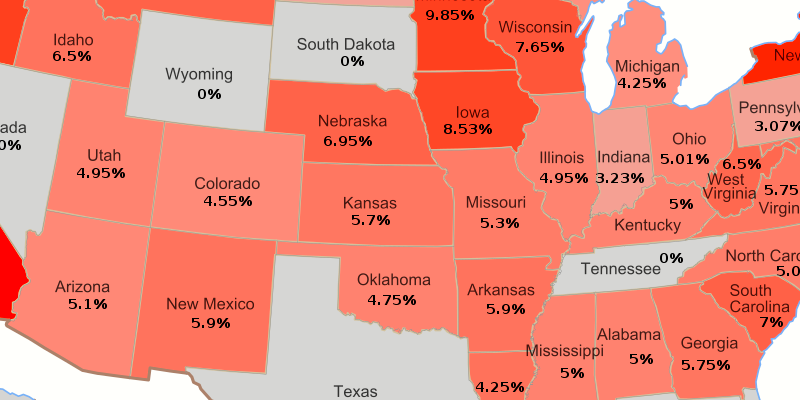

The State's Total Tax Burden

States that opt out of collecting income taxes do so by collecting other forms of revenue or cutting back on essential services.

When comparing states, it may be more useful to look at the overall tax burden rather than just the income tax rate. This is the percentage of personal income tax at the state and local levels.

Cost of Taxes in Alaska: 5.10 Percent

There is no personal income tax or statewide sales tax in Alaska. Alaskans pay the lowest combined state and local tax rate (income, property, sales, and excise taxes) of any 50 states, at just 5.10 per cent of personal income.

Mineral lease rentals and royalties are a major source of revenue for the Alaska Permanent Fund Corp., which distributes a yearly dividend to all Alaskans.

Cost of Taxes in Florida as a Whole: 6.97%

State residents go because of the year-round sunshine and low-to-moderate winter temperatures. While Florida's sales and excise taxes are higher than the national average, the state has the sixth-lowest tax burden in the US at just 6.97%. Due to higher-than-average home prices, Florida has the 31st most expensive housing market. The Sunshine State still ranked #10 on the "Best States to Live In" list by U.S. News &' World Report. At $9,645 per student in 2019, Florida had one of the lowest school system budgets in the country.

Statewide Taxes in Nevada Add Up to 8.23%

Nevada's economy primarily relies on sin taxes on alcoholic beverages and gambling, as well as taxes on casinos and hotels, as well as heavy sales taxes on everything from groceries to clothing. Consequently, Nevadans pay the second-highest total state tax burden, at 8.23% of personal income. However, compared to the other states, it still manages a respectable 22nd place. However, due to its high living and housing expenditures, Nevada ranks at the bottom (41) in terms of affordability. According to U.S. News &' World Report, this is the 37th best state in which to live.

Average Tax Rate in South Dakota: 7.37 percent

Like many other tax-free states, South Dakota brings in money through sales taxes on things like cigarettes and alcohol. The land of the Lakota Sioux and the Black Hills has a sales tax rate towards the top of the list and a property tax rate over the national average. The Atlantic reports that South Dakota's lack of an individual income tax is made possible partly because the state is home to a number of significant corporations in the credit card sector, as well as higher property and sales tax rates.

8.19% of Texas' Income Is Taxed

Personal income taxes are so unpopular in Texas that the state constitution expressly forbids them. Still, Texas must find a way to pay for infrastructure and services, so the state relies on revenue from sales and excise taxes. Some places have a sales tax of up to 8.25 per cent. Additionally, property taxes are higher than in most states, contributing to a total tax burden of 8.19 per cent of disposable income. Nonetheless, Texans pay one of the smallest shares of their income in taxes of any state in the Union (Texas is ranked 19th).

A Statewide Tax Burden of 8.34% in Washington

Washington is home to several significant businesses, and its lack of a statewide corporate income tax has attracted many young professionals. Only 15.9% of its population is 65 or older. The cost of living in Washington is higher than the national average due to high sales, excise taxes, and higher petrol prices. The state's 8.34% tax burden ranks it 26th out of the 50 states. Washington ranks 44th in terms of affordability, largely due to its residents' having to pay above-average prices for necessities like food and shelter.

Wyoming's Overall Tax Rate is 6.14 per cent.

Wyoming is the second least densely inhabited state, behind only Alaska, with an estimated six persons per square mile. There is no state income tax for individuals or businesses, no tax on retirement income, and low sales tax rates for residents. Third-lowest in the nation in the total tax burden, at 6.14 per cent of personal income (including property, income, sales, and excise taxes).