Life Insurance Guide

Life Insurance Guide

Purchasing life insurance may be one of the most important and lasting financial decisions the head of household makes for the family. Even if the primary caregiver is suddenly absent, life insurance can ensure that the family’s most pressing financial obligations are fulfilled. These include commitments to mortgage and car payments, medical expenses, and student tuition.

Since policy options vary according to the needs of the policyholder, purchasing life insurance can also be very difficult. Before committing to one policy instead of another, consumers must carefully consider their underwriting needs and choices. Let's start with the basics:

What is life insurance?

Life insurance is a contract between an insurance company and the policyholder. The life insurance policy guarantees that in the event of the death of the insured, the insurer will pay a sum of money to the designated beneficiary in exchange for the premiums he paid during his lifetime.

Our life insurance guide explains the basics of how life insurance works and how it plays an important role in financial planning. You may already know that life insurance protects your loved ones by paying death compensation after you die. But this is just the beginning of the life insurance business. In our life insurance guide, we explain how to use life insurance throughout your life and how it can be combined with other parts of your financial plan to help you achieve your financial goals faster.

At the most basic level, life insurance is a contract between you and the insurance company. According to the terms of the contract, you regularly pay premiums to the company in exchange for a certain amount of insurance. If you die within the coverage, the life insurance company will pay the death benefit to your designated beneficiary.

Although death pensions are the main reason people tend to get life insurance, certain types of insurance policies accumulate cash value, that is, money increased through tax incentives that can be used in your life.

How does life insurance work?

There are two types of life insurance: term life and permanent life, including whole life and universal life insurance. Whole life insurance provides you with lifetime protection, while term life insurance provides you with protection for a certain period of time.

Who should buy life insurance?

Life insurance provides financial support for surviving family members or other beneficiaries after the death of the insured. Here are some examples of people who may need life insurance:

Want to leave money to elderly parents who take care of their adult children

l Parents of adult children with special needs

l Adults who jointly own property

l Parents with minor children

l Young people whose parents bear private student loan debts or co-sign loans for them

l Young people who want to lock in low interest rates

l Married pensioners

l Wealthy families expected to owe inheritance taxes

l Families who cannot afford funeral expenses

l Companies with key employees

How much life insurance do I need?

A common rule of thumb for life insurance is to get a death benefit that is at least 10 times your salary. But this is only a starting point, because there is no one-size-fits-all figure for how much death benefit you need. Let's face it: everyone's situation is different.

So how much life insurance do you need? Well, this may depend on several factors, including:

l How many beneficiaries do you have

l Whether you have a mortgage or other debts

l Your income

l How long may your beneficiaries need support

l Any investments or assets you may have

l Any future expenses you are trying to pay (for example, your child's future college or wedding expenses)

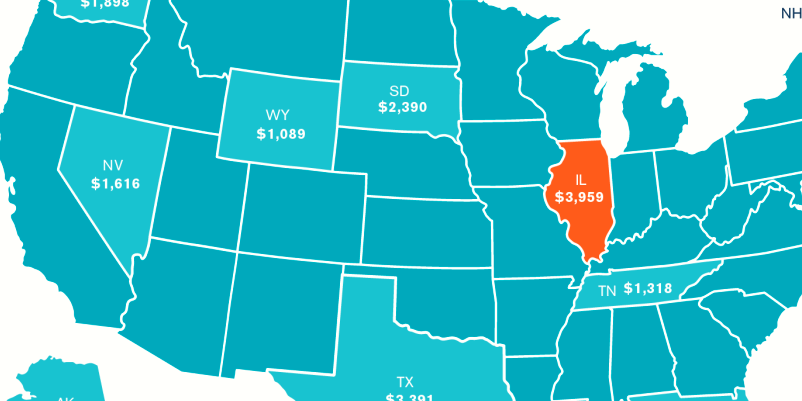

It is a good idea to get at least some life insurance protection as soon as possible, because the cost of life insurance mainly depends on your age and health. The younger and healthier you are, the cheaper your premiums. Many insurance companies allow you to add benefits when you are young, giving you the right to purchase more insurance without the need for additional health checks in the future. Locking in health is a key reason to buy life insurance when you are young.

Then, as your needs change over time, you can update your life insurance and financial plans to reflect your new reality.

Use life insurance cash value at retirement

When you retire, you usually invest part of your savings. In the long run, market-based investment is often superior to other forms of savings. But as we all know, the price of stocks will fall from time to time. After retirement, you will sell stocks to earn income. During a market downturn, if you have to sell more stocks to earn the same income, you may end up eating up your retirement reserves.

This is where the cash value of life insurance comes into play. Since the cash value of life insurance has nothing to do with the stock market, you can use the cash value of permanent life insurance after retirement to create income when the market is down. This allows you to wait until the stock price recovers before selling.

Where can I buy life insurance

Get group life insurance through work. If you get a package of benefits through work, your employer may provide some form of life insurance through a group plan. Usually, these basic plans provide you with a fixed amount of death compensation with little or no fees. Although this is a great benefit, the life insurance you get through work may not be enough. There are usually two forms of life insurance obtained through work:

Basic life insurance

If provided, basic life insurance is usually provided free of charge. By default, you can get this free insurance. The coverage of basic life insurance is usually fixed, which means that everyone gets the same benefits; or the coverage may be a multiple of your annual salary (usually one to two times your income). Although any insurance is certainly helpful, it is usually not enough to provide extended financial protection for your loved ones.

Supplementary life insurance

This is sometimes provided in addition to basic life insurance. You will purchase this additional insurance at your own expense, but you will continue to enjoy the group rate. The additional benefit allows you to buy anywhere from a few thousand dollars to several times your annual salary.

Although obtaining life insurance through work can bring great benefits, there are also some drawbacks. First, it is usually not portable, which means that if you leave your job, you may suddenly find yourself out of insurance. In addition, the cost of group insurance may change over time.

Personal life insurance

Since buying group insurance through work may not be enough, many people choose to buy individual life insurance through financial advisors. Working with someone can be useful because they can help you discuss what costs you need to bear in case something happens, what level of insurance you may need, and which type of policy is best for your financial situation.