How to Create a Solid Financial Plan in Your 30s

Now that you are in your 30s, you have a stable job, you may have paid off your student loans, and life is on track. But being in your 30s also means you have many life milestones to achieve, such as buying your home, getting married, saving for retirement, etc. If you are already saving on the side, you have already set the building stone and are more equipped for a better future.

In this article, we help you understand and make informed financial decisions to solidify your financial future.

Start Saving Early for Your Retirement

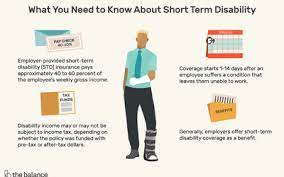

You never know when the responsibilities of life, such as marriage, kids, education, and more, creep up on you. As soon as you have a stable and well-paid job, you should start adding to whatever retirement fund you are planning. It can be an account, authorized bank, or financial institution retirement fund plan.

This decision involves looking at your lifestyle and how significant your spending is. But health and wealth don't always stay, so consider it an emergency fund and start saving early.

Understand Your Present Situation and Your Net Worth

No matter what you do or which of these pieces of advice you follow, the most important is to know where you stand. The following are some things you should be aware of about your life.

· How much do you earn monthly, and how much do you buy things from?

· What do you need to spend, such as groceries, rent, utility bills, etc?

· Are there any liabilities, such as debts or loans? You need to adjust them within your budget to keep them from overflowing.

· What is your net worth, and are you in good financial standing?

These factors allow you to make better financial decisions like spending less, setting aside money for necessities, etc.

Your Future Goals or Milestones

This section is vital once you understand your net worth and where you stand according to your present financial situation. Now, you can answer some critical questions about your life goals and milestones that you must target.

1. Do you plan to get married soon if you ever want to?

2. When do you want your first child, and how many are you planning to?

3. Do you want to buy yourself a new home, or do you want to take a loan to support that plan?

4. If you can, do you want to retire early with substantial savings?

5. Do you love travelling and want to explore the world?

6. What savings are you planning to have for your kids’ education?

Reading these goals in the form of questions might give you a headache, as these are significant responsibilities. We aren't asking you to fix them today because that's what your 30s are for.

Start by tackling one of these goals and chart out a plan. Next, discuss this with a financial expert and consider all your options. It would help if you started saving or earning more to have enough money to fulfil your goals.

Focus on Your Career

You need to earn more to achieve all the above goals, which is the easiest way. By your 30s, you already have a job based on your education and the marketable skill you are refining. Enhance that skill and specialize in it even more. Go back to education if you have to.

The better you are in what you do and constantly improving, the more you will be in demand. This constant demand will allow you to work for a higher salary where your worth is recognized. Jump a job every 3-4 years to significantly boost your salary.

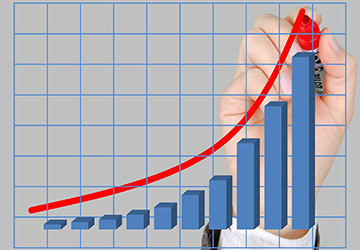

Higher salaries mean more extra income to invest in a varied portfolio. Now, you will have a steady income from these investments other than what you earn in your career.

Avoid Increasingly Lavish Lifestyle as Much as Possible

It is standard that when individuals start earning more, they start spending that matches their income. Even if they were sufficiently satisfied with their previous income, most people pay less when they have more money.

Many purchases are expensive, and you don't need to make them. The best way to avoid that is to fix your savings hard and not reduce them in such cases. Once you learn to save for a few months, you have already tuned your lifestyle around it.

Choose Investment Portfolios That Are Interesting To You

While many experts might say otherwise, you should choose investments that cater to you. If you need a home, buy it even if you have to take a loan. Once you do, you can purchase another living space and rent it out. This way, you will have a constant influx of money.

It is better to put money in a savings account or bonds, but if you feel more comfortable with real estate investments, you do. The market will always have ups and downs, no matter what investment avenue you may look at.

However, it is always advisable to diversify your portfolio. So, if you are earning extra money from your rentals, you can always put some of it into other things, such as savings or bonds.

Final Thoughts

Life is all about choices: what you eat, where you live, what profession you choose, and how you spend your money. Sometimes, you plan something that works out differently than intended. You can always bounce back if you have solid planning and built a solid foundation.

As mentioned in the article, having a marketable skill will permanently save your hide, no matter the situation. Enhance your skills and earn as much as possible to have better chances of spending them.